The Carney Government’s first Federal Budget has set the stage for Canada’s long-term domestic response to ongoing economic uncertainty. The document seeks to place the Canadian economy, industries, and households on sure footing by investing in community infrastructure and boosting Canadian productivity and competitiveness.

In his presentation of Budget 2025, Finance Minister François-Philippe Champagne has positioned the federal plan as one of generational investments — a conscious pivot from the rhetoric of austerity to a narrative of prosperity. With the introduction of a new Capital Budgeting Framework, the government signals that it intends to prioritize major capital projects, housing, clean energy infrastructure, and workforce development, while distinguishing these from routine operating expenditures.

At the same time, the message remains that fiscal discipline is not abandoned; ministries have been asked to identify multi-year operational savings while investment is front-loaded. Politically, the framing serves a dual purpose; it signals a long-term agenda to Canadians, while addressing the need for credibility in the near term. While the public is the primary audience for any budget, the opposition parties, whose support is needed to pass the budget, are also a key focus of the document.

Titled Building Canada Strong, the Budget focuses on four main areas:

Housing, with an investment of $25 billion over five years

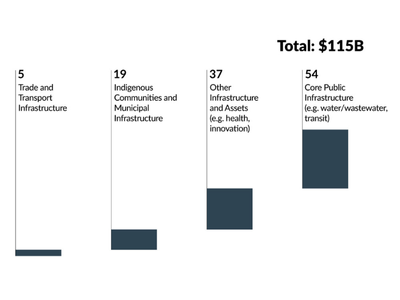

Infrastructure, with an investment of $115 billion over five years

Defence and security, with an investment of $30 billion over five years

Productivity and competitiveness, with an investment of $110 billion over five years

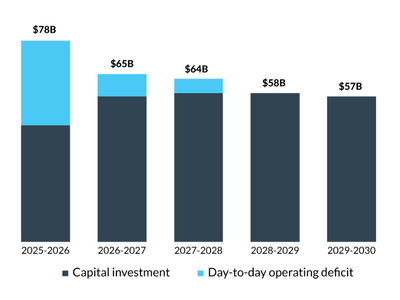

As anticipated, the Budget also reframes how the government accounts for expenditures. As the first Federal Budget to separate operational spending and capital spending, it signals a deficit far greater than what was projected in 2024-2025. Minister Champagne and Prime Minister Carney are now targeting the return to a balanced operational budget by 2030. The approach provides the option to invest in major initiatives now to support the economy, while reducing the overall cost of delivering services and programs to taxpayers in the medium-term. New spending will be partially offset by operational reductions across departments.

The 2025-26 deficit is a projected $78.3 billion, a significant increase from the $42.2 billion 2025-26 deficit forecast in last December’s fiscal update. This deficit is projected to decline over the next four years to $56.6 billion by 2029-30. To offset this deficit, the government expects to enable $1,080 billion in total capital investment.

Budget 2025 lands during a period of slow growth and global uncertainty, shaped by U.S. tariffs, weak investment, and soft labour-market conditions. These pressures have dampened business confidence and constrained government revenues, reinforcing the federal focus on fiscal discipline.

Last week, the Bank of Canada cut its key rate to 2.25%, its second consecutive reduction, citing tariff-related disruptions and weaker demand. The Bank projects GDP growth between 0% and 1% this year and modest recovery thereafter. Though the unemployment rate in September held steady at 7.1% after months of consecutive losses, employment has slowed across trade-sensitive industries, and youth unemployment remains at levels not seen since the 2009 financial crisis. The inflation rate in September remained slightly above the target range at 2.4%.

These dynamics underscore a fragile recovery — one that the government hopes the Budget will stabilize through targeted investments and a new approach to fiscal management.

As the first confidence test for the Carney government since the election, Budget 2025 will serve as an early measure of the new administration’s ability to navigate both political dynamics and policy execution. Its success or failure will signal how effectively the Liberals can build working relationships across party lines in a minority Parliament.

Because the Budget constitutes a confidence vote, its defeat would trigger an early election. The governing Liberals are three votes short of a majority, requiring support — or lack of opposition — from at least three non-government MPs.

Minister Champagne has described Budget 2025 as a plan with “no surprises,” reflecting an effort to craft a package that could attract cross-party support. The emphasis on fiscal restraint and a balanced-path narrative may be designed to make the Budget more palatable to Conservative MPs, particularly those aligned with calls for spending discipline. However, the Conservatives have focused messaging on “no more sacrifices” by Canadians in recent weeks.

The Bloc Québécois has presented 16 preconditions and is not expected to back the Budget. The New Democratic Party remains the most likely source of support, whether through a small number of MPs or selective cooperation rather than a formal party-line vote. The party is in the early stages of a leadership race and is not positioned to fight a fall election, making abstentions or limited support from individual members the most likely scenario.

With limited pre-budget outreach to other parties, the Carney government faces a narrow window to build support before debate begins. Both the Conservatives and the NDP have strategic reasons to avoid triggering an early election, which benefits the Liberals as they seek support.

Budget 2025 places renewed emphasis on public and private investment in infrastructure as a driver of productivity and long-term growth. The government has set out more than $115 billion in planned infrastructure spending over the next five years, alongside a broader fiscal shift that prioritizes capital investment over day-to-day program spending.

Five-year horizon (billions of dollars, accrual basis)

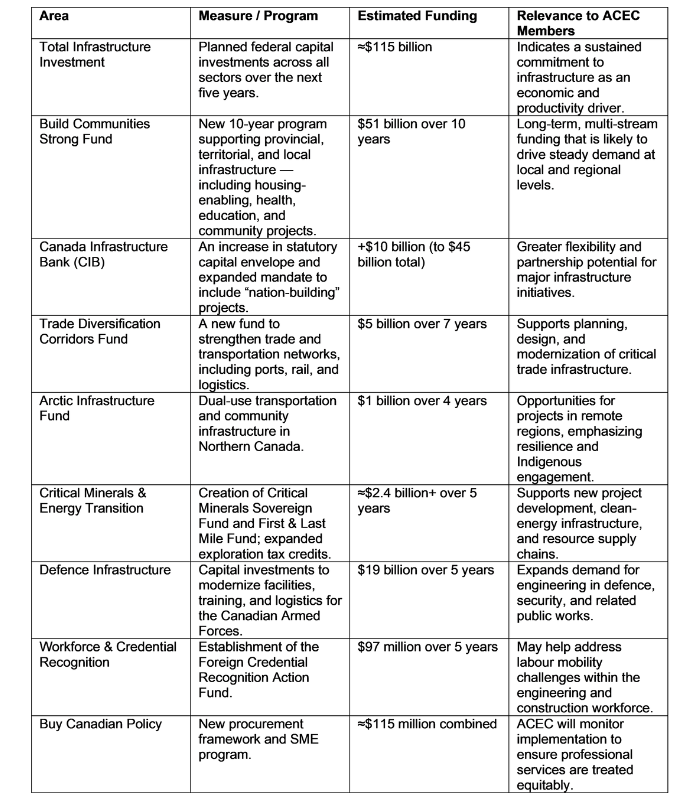

For consulting engineering firms, this translates into a potential pipeline of projects across multiple sectors. The new Build Communities Strong Fund, Trade Diversification Corridors Fund, and Arctic Infrastructure Fund are expected to support transportation networks, housing-enabling infrastructure, clean energy, and community facilities. These measures align with several of ACEC’s pre-budget recommendations for sustained, predictable, and productivity-enhancing investments.

The Building Communities Strong Fund, which commits $51 billion over 10 years, directly addresses ACEC’s recommendation for a renewed and ongoing commitment for community infrastructure. However, ACEC also notes with some surprise that there was no specific reference to the Canadian Infrastructure Council or the National Infrastructure Assessment.

Budget 2025 does include $213.8 million over five years, starting in 2025-26, for the Major Projects Office. This funding will also support the Indigenous Advisory Council. Of this amount, $19.8 million will be sourced from existing departmental resources.

The decision to expand the Canada Infrastructure Bank’s capital envelope from $35 billion to $45 billion and broaden its mandate to include major “nation-building” projects is also consistent with ACEC’s call for more flexible financing tools. Investments in critical minerals, northern and defence infrastructure, and trade corridors will similarly create opportunities for member firms engaged in resource, transportation, and resilience projects.

Other measures with implications for the industry include commitments on foreign credential recognition, immigration levels, and a new Buy Canadian Policy, which will require close attention to ensure professional services are treated equitably.

Overall, Budget 2025 reflects many of the themes advanced by ACEC in its pre-budget submission: productivity through infrastructure, partnerships with industry, and a long-term investment horizon. ACEC will continue to work with federal officials as program details are developed to ensure that consulting engineering firms can contribute fully to these nation-building initiatives.

(Funding figures are approximate; amounts are not cumulative.)

As program details and funding frameworks take shape in the months ahead, ACEC will continue to engage with officials and partner organizations to ensure that implementation reflects the principles of transparency, collaboration, and value for money.

While Budget 2025 signals renewed federal commitment to long-term infrastructure investment, its success will ultimately depend on effective delivery and the meaningful involvement of Canada’s consulting engineering sector in shaping and executing these nation-building projects.

ACEC will also keep members informed as funding programs are rolled out, highlighting opportunities and potential implications for the industry. By staying connected through ACEC, its member firms can help shape the implementation of these measures and ensure that Canada’s renewed focus on infrastructure translates into lasting benefits for communities, the economy, and the industry.

This communication has been prepared by ACEC and its government relations partner First Lake Solutions for the convenience of its member firms. It is not intended as a comprehensive guide to the budget. For details on Budget 2025, please visit the Government of Canada’s Budget 2025 website.

ACEC, the voice of consulting engineering in Canada, advocates for a business and regulatory climate that allows its members to provide a high level of service and value to their clients. For information on ACEC’s advocacy on behalf of its members, visit www.acec.ca.